By Mike Jesowshek, Special AFS Contributor

If you’re like most fitness studio owners, just the thought of managing any type of tax makes your stomach churn. Not to mention understanding the books to drive your business forward. Sales tax, along with other taxes, involves thousands of pages of tax law that can be worded in confusing ways. Our goal is to try to help you understand the basics to guide you in the right direction.

With that being said, we always recommend you consult a sales tax professional to understand your true sales tax exposure.

State/Local Level

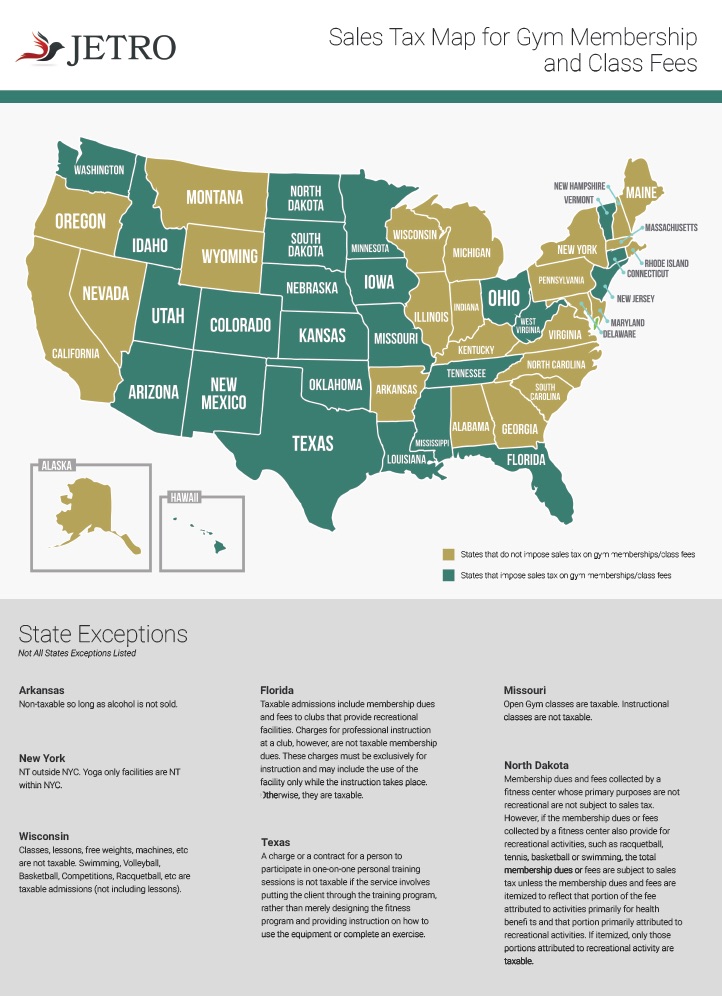

There is no federal sales tax, sales tax is only imposed on the state and local level. This means that every state and locality can have different laws and rules that need to be followed. It is important to note that even if a state doesn’t have a statewide sales tax, there may be a locality within the state that does levy a sales tax. We have provided a map to assist in determining if your state imposes sales tax on gym memberships and/or class fees.

Sales Tax Nexus

Generally stating, having “sales tax nexus” means you have a sufficient physical presence within a state/locality, thereby requiring you to comply to the sales tax laws there. If you have nexus in a state that has sales tax requirement, then you would need to file there. If you do not have nexus in a state, then no sales tax filing is required. Now, you are probably wondering, how do I know if I have nexus? Here are three general guidelines to help answer that question:

- Property/Location – If your business is physically located in a state, that would qualify as nexus. Example: A fitness studio with physical locations in Oklahoma City, Dallas, and Memphis would

have sales tax nexus in Oklahoma, Texas, and Tennessee.

have sales tax nexus in Oklahoma, Texas, and Tennessee. - People – If you have employees in a state, that would qualify as nexus. Example: You have a fitness studio in Dallas, but you have a virtual instructor in Miami, you would have sales tax nexus in both Texas and Florida.

- Inventory – This doesn’t come up as much for fitness studio and gym owners, but if you have a warehouse or inventory in a state, that would qualify as nexus. Example: You have a fitness studio in Dallas but also created your own type of protein drink. For fulfillment purposes you keep your protein drink inventory in San Diego. You would have sales tax nexus in both Texas and California.

I have nexus, now what?

After researching and talking to a sales tax professional, you have found out that you do have sales tax nexus in one or more states. Next you need to register for a sales tax license or permit in the states you have nexus. This will allow you to begin collecting sales tax from your customers. Once you’ve received your license or permit, it is important that you file your sales tax returns by the required due dates (usually monthly, quarterly or annually). Even if you have no sales for a specific period, you will need to file a zero return.

Since sales tax can be so complicated, especially when you start to look at the local level, do your research to make sure you are collecting the correct amount from your customers. If you are unable to find the rates for your specific location, contact a professional or find a software that can help determine this for you. Many point of sale or class software have a sales tax piece built directly into them.

Conclusion

State and local sales tax laws can be complicated. If you are unsure what amounts you should be collecting from your customers, we always recommend contacting a sales tax professional to learn about the potential exposure and tax rates your business may have. If you are interested in learning more about the topics above or any other bookkeeping or tax related items, send me a message, I would be more than happy to chat!

This guidance is for informational purposes and does not constitute legal or tax advice. We also recommend you speak with a professional regarding your specific scenario. JETRO and Associates shall not be responsible for any liability related to the guidance herein.

Please note: The graph contained within this article is current through July 2017, laws may have changed since this was posted.

Mike Jesowshek, CPA is the founder of the accounting firm JETRO and Associates. He has a strong passion for both fitness professionals and technology. He helps provide a digital accounting, bookkeeping, and tax solution for studio and gym owners who are looking to take it to the next level by utilizing modern, cutting edge technology.

Join the Conversation!