By Steven Tharrett, Special AFS Contributor

By Steven Tharrett, Special AFS Contributor

The health/fitness club business is a people-intensive industry. The average facility under 20,000 square feet (the majority of fitness studios) employs five full-time staff and six part-time staff with a payroll equivalent to 42% of revenue. This points out the critical importance of staff to create and sustain the experiences that clients and members expect, and to highlight the fact that with this reliance on staff to deliver our offering comes a reasonably hefty price tag; a cost that typically consumes 40% to 50% of revenue.

One of the more frequently heard comments in the industry is that its employees are the heart of the business; the fuel that drives the engine. It is the employees, and in many instances the independent contractors, both full-time and part-time, that deliver the services, create the magic moments for the clients, and foster the relationships that are so vital to success.

Similar to the separation between church and state, the lines between employees and independent contractors has been and remains a challenge for the fitness industry. All too frequently clubs and studios choose to have independent contractors deliver their brand offering and in some instances, the majority of their services, a decision that can be fraught with problems. Many operators perceive that retaining independent contractors is a less expensive approach to business than hiring employees, in part due to the cost savings associated with not having to provide the benefits or assume the federal and state mandated taxes associated with hiring employees.

Similar to the separation between church and state, the lines between employees and independent contractors has been and remains a challenge for the fitness industry.

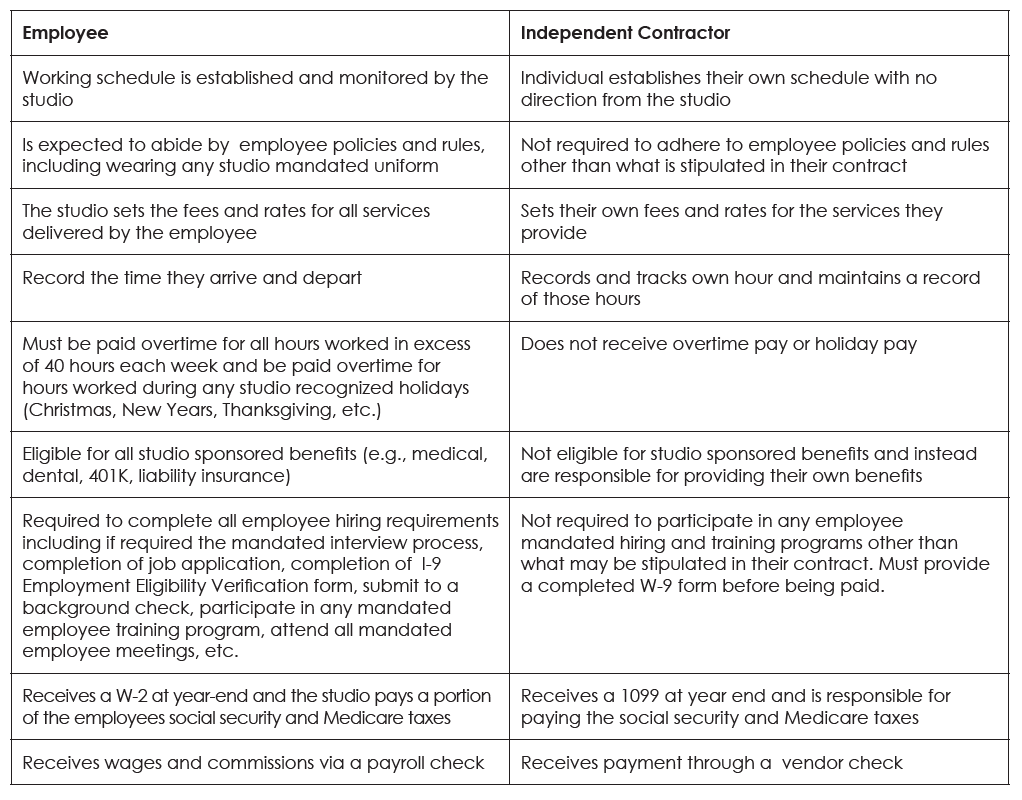

The unfortunate truth is that the cost and liability increases when you retain independent contractors, rather than hire employees. This is especially true when you unknowingly create an employee environment. It is critical, however, that studio operators clearly understand the difference between an employee and an independent contractor. The chart below details several of the basic differences between the two.

The fundamental differences are quite significant. State and federal laws are adamant about businesses adhering to the policies concerning these differences. Studios that attempt to pay people as independent contractors, but treat them as employees, open themselves to potential fines from the government, not to mention lawsuits filed by contractors or staff. If the studio identifies someone as an independent contractor, but that individual is characterized by any of the criteria identified in the employee column in the chart below, then that person is an employee and must be treated as such.

In the event your business model for the studio is reliant on retaining independent contractors, rather than hiring employees, there are several critical points you need to address, among them:

- Make sure you have a legally valid agreement, signed by both you and the independent contractor. The agreement should set forth the terms, conditions and fees associated with the working arrangements.

- Make sure the contractor completes and signs a W-9 form before being retained. If the contractor is renting access; it is still wise to obtain a completed W-9.

- Make sure the contractor provides evidence of professional liability insurance. If they don’t have insurance, don’t retain them. Ideally you want the contractor to list the studio as an additional insured. Make sure that your agreement with the contractor requires them to provide evidence of insurance.

- If the contractor will be providing coaching and instructional services (e.g., group exercise instructor, personal trainer), then require evidence of certification from a nationally recognized certifying agency. You should also require evidence that they are certified in AED/CPR.

- Require the contractor to submit an invoice for their services, preferably on a weekly basis. Once the studio receives the invoice they can then proceed to process it for payment.

- If the contractor will be renting access to the studio (a practice used by many studios), you will want to include these terms in the agreement. If the contractor is renting access, the contractor will not invoice the studio; instead, the studio will invoice the contractor.

Stephen Tharrett is currently the owner and president of Club Industry Consulting, a global consulting business based in the U.S. He is also a co-founder and partner in Club Intel, a member and brand insights firm. Stephen is also a partner in Dinosaur Games, a start-up video game developer based in Austin, TX. From September 2008 until October 2010, Stephen served as CEO for the Russian Fitness Group, a $170 million dollar privately held fitness club company that owned 30 clubs and franchised an additional 20 clubs throughout Russia.”.

Join the Conversation!